How much can i borrow with existing mortgage

Second mortgages can be structured as either a standalone deal or a piggyback loan. Figures given by this calculator or the provision of a Decision in Principle do not constitute an offer to lend to you.

Https Www Takebestloans Com Loan Against Property Loan Against Property Refinance Calculator Home Improvement Loans Home Loans Home Equity Loan

All figures provided by our How much can i borrow mortgage calculator are an estimate only please call us to discuss your requirements in more detail.

. Please call us to discuss. However as a drawback expect it to come with a much higher interest rate. The longer term will provide a more affordable monthly.

Find out more in our Guide. Subsidies are subject to clawback if the loan is repaid in full within 3 years from 1st loan disbursement date and cannot be stacked with S2200 Cash Reward awarded under the. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage.

You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate.

But ultimately it. Calculate your monthly mortgage repayments to see what you could afford to borrow when moving house remortgaging or buying your first home. Use our mortgage calculator to see how much mortgage you can get in the UK how much mortgage you can afford and how much deposit you need for a mortgage.

This information does not contain all of the details you need to choose a mortgage. The loan is usually repaid when the last surviving borrower dies or moves out of the home into long. Buy-to-let calculator see if we could lend you the amount you need for a property youll rent out.

31000 23000 subsidized 7000 unsubsidized Independent. It takes about five to ten minutes. Whatevers left over is.

Use our offset calculator to see how your savings could reduce your mortgage term or monthly payments. How long will I live in this home. When it comes to calculating affordability your income debts and down payment are primary factors.

Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Find out How Much You Can Borrow for a Mortgage using our Calculator. Factors that impact affordability.

The maximum amount you can borrow may be lower depending on your LTV and following our assessment of your personal circumstances. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any outstanding debts. In order to determine your expendable income they will deduct all of your existing outgoings from your annual income to find your debt to income ratio.

See the average mortgage loan to income LTI ratio for UK borrowers. Buying a new property is a big commitment. The calculator also helps you determine the effects of different interest rates and levels of personal income on how much mortgage you can afford.

Many first-time homebuyers make this mistake and end up house poor with little. Affordability calculator get a more accurate estimate of how much you could borrow from us. Mortgage advisers available 7 days a week.

How much can I borrow. This mortgage finances the entire propertys cost which makes an appealing option. How much can I borrow.

Designed for customers aged 55 or over a later life mortgage lets you borrow money based on the value of your home as a loan secured against it while you continue to live there. Avoid private mortgage insurance. You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit.

Standalone second mortgages are opened subsequent to the primary mortgage loan to access home equity without disrupting the existing arrangement. Please get in touch over the phone or visit us in branch. Just because a bank says it will lend you 300000 doesnt mean that you should actually borrow that much.

If youre applying for an interest-only. A maximum of 2 applicants can apply for a new HSBC mortgage. If you already have a mortgage with us you can take your first direct mortgage with you when you move house known as.

That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. It will depend on your Salary Affordability Credit score. Paying 500 a month over 25 years means you are paying back 150000 but your mortgage will also include interest - which is charged per.

What mortgage can I get for 500 a month in the UK. Factor in income taxes and more to better understand your ideal loan amount. This mortgage qualifying calculator takes all the key information for a mortgage and lets you determine any of three things.

This assumes that you dont have any existing debts and a clear credit rating. 1 How much income you need to qualify for the mortgage or 2 How much you can borrow or 3 what your total monthly payment will be for the loan. Whether youre a first-time buyer moving home remortgaging or buying an additional property our mortgage calculator can give you an idea of.

You could get an agreement in principle that lasts 6 months sorted in a 30-minute phone call. A combined salary of 100000 could be eligible to borrow 400000. Calculate how much house you can afford with our home affordability calculator.

While your personal savings goals or spending habits can impact your. This mortgage calculator will show how much you can afford. This Promotion is valid from March to December 2022.

Offset calculator see how much you could save. If you already have an existing mortgage elsewhere your last years mortgage statements. Typically the home buyer purchases a primary mortgage for the full amount and pays the required 20 percent.

Fee-free valuation Fee Saver mortgages available too mortgage terms up to 40 years. When you put at least 20 down on a conventional loan or 20 home equity on a refinance you can avoid paying monthly private mortgage insurance premiums PMI. Total subsidized and unsubsidized loan limits over the course of your entire education include.

How much house you can afford is also dependent on the interest rate you get because a lower interest rate could significantly lower your monthly mortgage payment. Youll need to obtain an Illustration before you make a decision. Mortgage calculator UK - find out how much you can borrow.

Mortgage deals for existing customers. Our maximum mortgage calculator helps you calculate the maximum monthly mortgage payment and total mortgage amount you can afford.

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information

Home Loan Downpayment Calculator

Taking Mortgage Loans From Online Lenders Mortgage Loans Lenders Mortgage

Pre Qualified And Pre Approved Are Two Different Things Mortgage Companies People Pre

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Home Equity Calculator For Excel Home Equity Loan Calculator Home Equity Loan Home Equity

Home Equity Loan Vs Line Of Credit Cobalt Credit Union

26 Great Loan Agreement Template Contract Template Agreement Templates

:max_bytes(150000):strip_icc():gifv()/mortgage-final-7b53158e65944796a0f896b2ff335440.png)

What Is A Mortgage

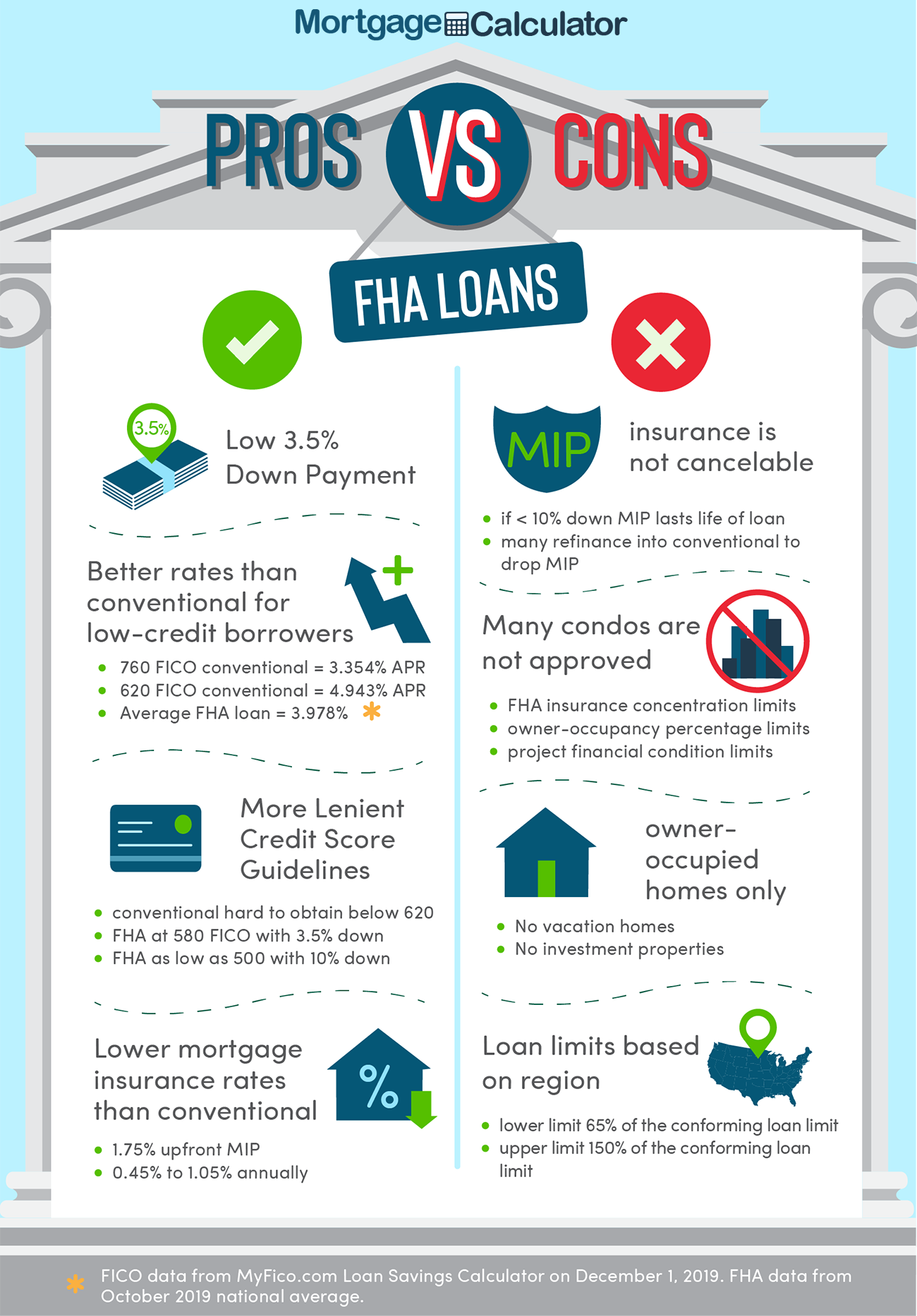

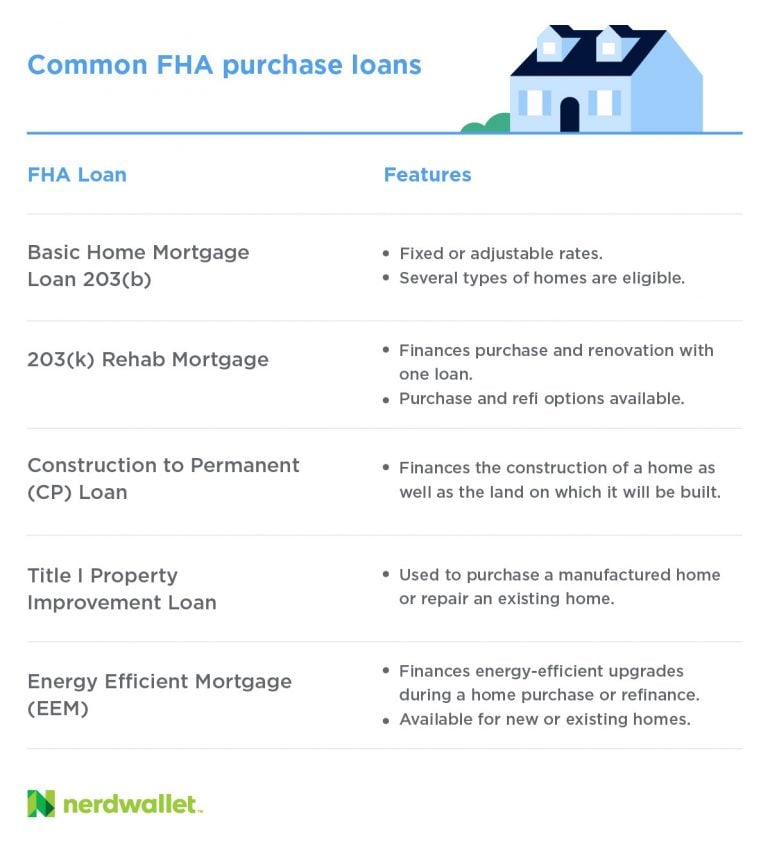

Fha Loan What To Know Nerdwallet

Qualifying For A Mortgage

Financial Loan Calculator Estimate Your Monthly Payments

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

What Is Loan Refinance What Are The Benefits Of Refinancing Refinance Loans Refinance Mortgage Loan

What Is Mortgage Refinancing Wealth Creation Academy Refinancing Mortgage Wealth Creation Mortgage

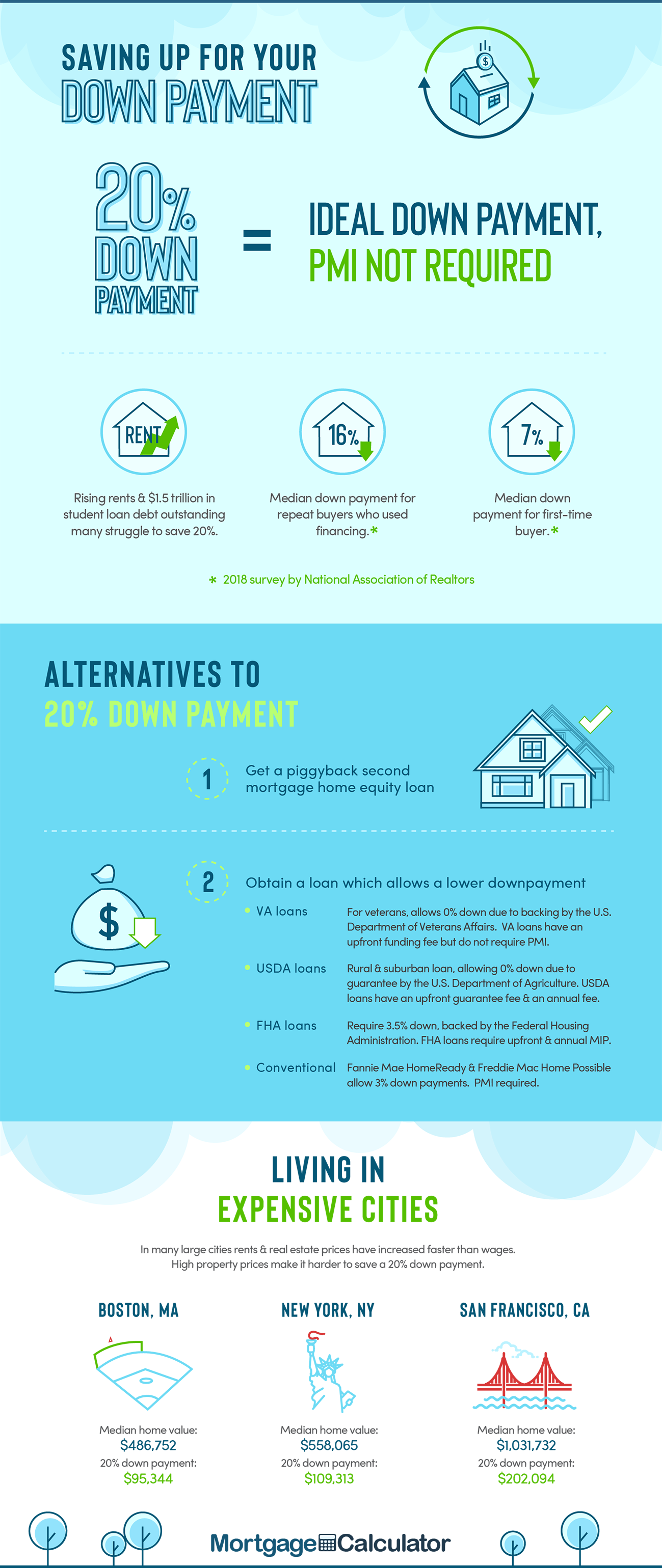

Saving For Downpayment Real Estate Infographic Home Selling Tips Home Buying

Future Value Appraisal Construction Loans